- The Australian dollar initially tried to rally during the trading session on Thursday to break above the 50-Day EMA, only to turn around and show signs of negativity.

- Ultimately, this is a market that I think is trying to settle into some type of short-term range to get ahead of the nonfarm payroll announcement.

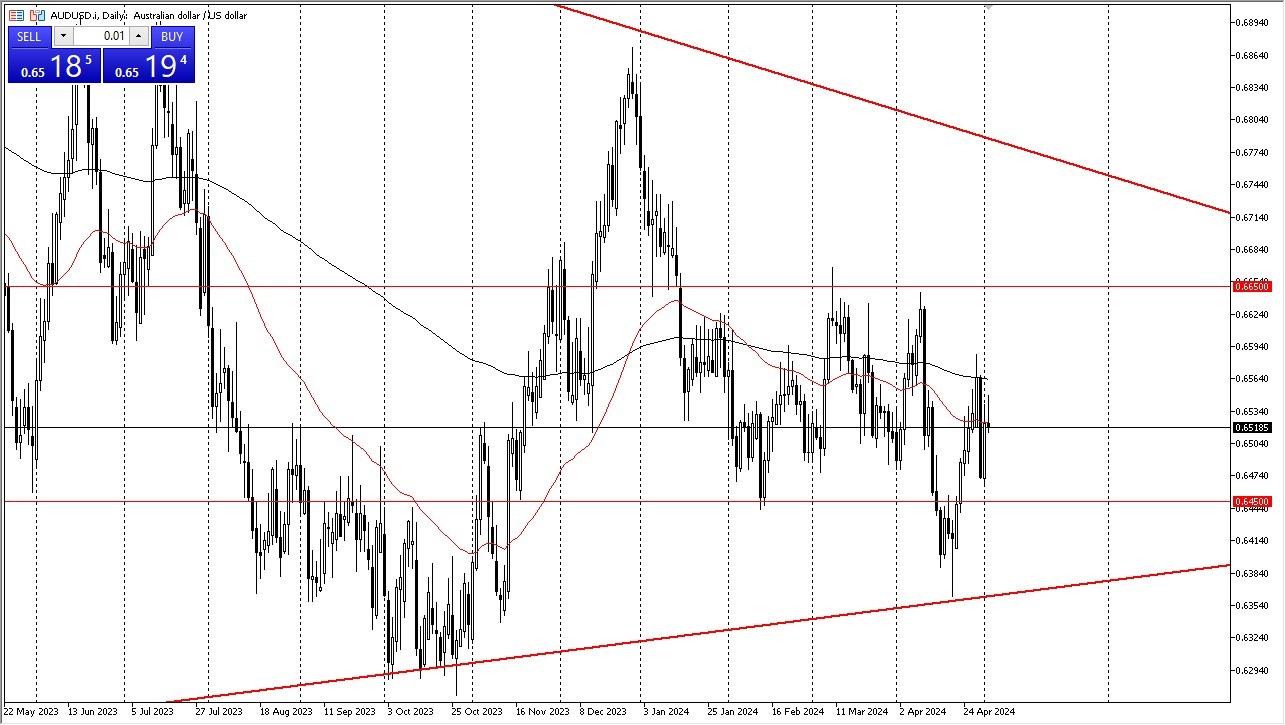

- Remember, this is a pair that has been consolidating between the 0.6450 level in the 0.6650 level for some time, with the occasional “throw over” coming into the picture.

As we are in the middle of this mess, and we just can’t really get any momentum, the reality is that this is still a very range bound market and I just don’t see how that changes. We would need to see some type of massive shock coming out of the United States to make this AUD/USD pair move at the moment, because remember that the Australian dollar is more often than not influenced by foreign countries such as China and other Asian economies that it is its own at times. Because of this, you need to be very cautious and recognize that any massive swaying in one direction or the other probably gets countered.

Sideways

I just don’t see how this pair breaks out of the sideways consolidation for any significant amount of time, so short-term range bound trading might be the only way to play this market. Ultimately, that would more likely than not be very fruitful, but at the end of the day we just don’t know. If this is a market that is going to make a move, I just don’t see any signs of it at the moment in the fundamental analysis doesn’t really dictate that it should be. With this, I think we continue to look at the same areas of support and resistance as an opportunity to fade overextension of momentum, and then simply rinse and repeat until we get some type of bigger move that breaks out of this range for a significant amount of time.

Ready to trade our daily Forex forecast? Here’s some of the top forex online trading Australia to check out.